The life we lead is very much a life that requires a lot of management both in terms of personal as well as financial. There are situations when you lack money for your expenses and at that point in life, all you need is a source that can aid such situations. The solution for such situations could be getting instant loans. Among those brilliant sites that provide loans when you are in need of money, one such source is PayDaySay. Here in the given article, we are going to provide PayDaySay reviews and how you can get quick cash with its help.

What is PayDaySay?

Life is an unpredictable journey and you never know what’s coming next. So one should be pretty much ready to deal with such sudden emergencies. If such an upcoming is in the form of a financial need then here’s PayDaySay for your rescue. PayDaySay is a financial provider that offers users small personal loans for their financial and emergency cash requirements. It has a facility that enables you to have access to such money-providing sources directly handled from your smartphone. It has its services provided in the quickest time possible. In the shortest time duration possible it gets your hands on the amount of loan you went for and just with the simplest details to be filled in. PayDaySay provides you the most simple and filling experience in terms of getting a loan.

Features of PayDaySay

All the amazing features of PayDaySay are as follows:

- Provides Multiple loans

PayDaySay provides you with all the different types of loans ranging from installment loans to business loans. It is thus a multi-provider for different types of loans. All the loans that it can provide you are:

- Installment loans

- Emergency loans

- Debt consolidation

- Business loans

- Rates and Fees

There is no such thing as a membership fee or any after-installing charges that it may cost. It just has the interest rate that would be defined by the lender you made the deal with. Although if we have an overview of the interest rate it is on the higher side.

- Security

When we get to know that through PayDaySay we are connected to the lender for further lending then it might cause a bit of a worry that the information that we provided safely. Yes, it is just used in the app and it’s not disclosed outside that to ensure the user’s complete security.

- Customer Service

The services that PayDaySay provides are just commendable. It offers you its support 24×7. Your queries are answered and paid attention to within 24 hours. You can connect to customer support on all days of the week. This makes it very user-friendly.

Advantages of PayDaySay:

- The simple application makes it the best place where people would go when they require loans as everyone is looking for a source that would make the process a bit light.

- Quick and paperless procedures are something that allows users to just access a loan just by adding some basic details and just with a few steps you will be able to complete the procedure without much paperwork.

- Acts as a multipurpose site that allows you not just money lending for a specific purpose but it allows you to access the loan for different purposes.

- Flexibility in loan amount is that it provides you with the liberty of getting loans from a wide range of rates.

- No additional cost for the pre-payment or part-payment fee.

- The tenure that it has is a short one which makes it useful and even more convenient for the user to repay his loan in a short time and maintain a good credit score. The tenure allowed by them is usually from 1 month to 3 months.

- The customer support provided by PayDaySay is just the most smooth experience as it is just a call or text away all for its user’s support.

Disadvantages of PayDaySay:

Everything has two sides to it one advantageous and the other disadvantageous. Although PayDaySay may have some brilliant features and also comes with some cons discussed below.

- High-interest Rates

Although it provides the user with instant loans, they charge a great amount as interest which makes it very tricky for the user. The high-interest rates are almost as much as 2.290% which is a great deal to repay. This enormous amount of interest charged by PayDaySay is one of the bangers for the user.

- Debt Trap

As this is an app that provides you short-term loans on a short tenure with pricier interest rates. If you are not able to repay the borrowed amount in time it can lure you into a debt trap which can be a disturbing thing for any user. So before using this to get your loans to make sure that you would be able to repay the loans on time.

- Access to your Bank Account

PayDaySay accesses your bank account and it is observed in many cases that if you are unable to pay the amount you can easily take it from your checking account.

- No Credit Build Up

PayDaySay does not affect your credit as they are not responsible to any credit bureau. It does not help you to build your credit furthermore.

- Judicious steps

They also can sue you if you fail to repay them in the long term which could easily turn into a legal battle.

After you know about all the pros and cons of payday say and are sure that this is what you want to choose to get your loan then the next thing you would want to know is mentioned below, which will provide you with an overview of the service provider.

Eligibility Criteria of PayDaySay

- Age 18 years and above

- Social security number

- Bank account

- Income information

- Address and other personal details

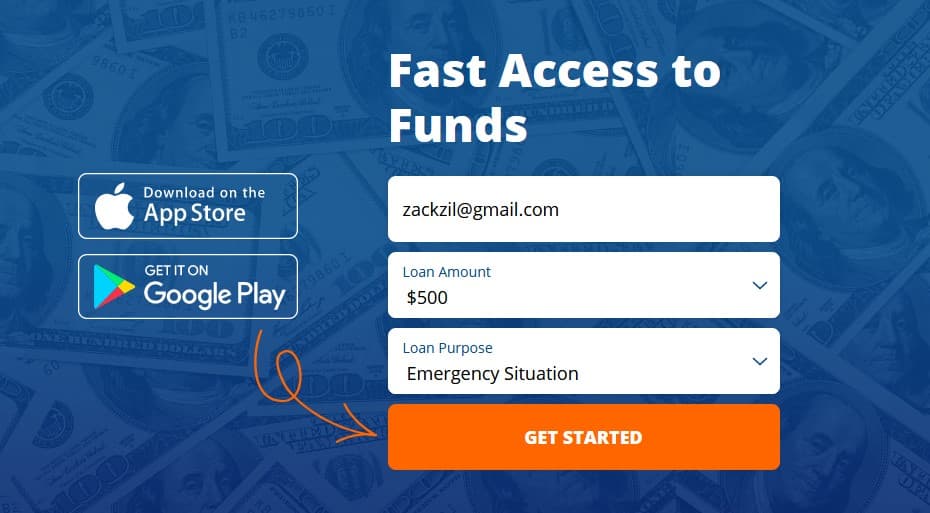

Steps to Get a Loan from PayDaySay

- First of all download the app on your device.

- Now begin with logging into it with all the personal details asked.

- After you have done this the system will research for you and bring you different options of lenders according to your loan demands.

- Review each of them carefully and go for the one that caters to your demands the best.

- Now you have to fill in the bank details to give your confirmation.

- The deal has been made and you would receive your loan in just a working day.

Frequently Asked Questions (FAQs)

1. Is PayDay Say reliable?

Yes, PayDaySay is reliable as many users have a good experience using it. It ranks among the top websites for payday loans which prove that many people are using it and it is a reliable source to get your loans.

2. Can a payday loan sue you after 7 years?

Yes, if a borrower has not paid the debt for so long PayDaySay can move to take legal action against them.

Final Verdict

Reviewing PayDaySay was a little heavy on the brain as you have so much to get and along with that, a few things could even hold you back. It is something that can be very helpful whenever you land in a situation where you need a quick loan. There might be a few things that might question you to choose or not but with just a little bit of awareness, things will ease for you. Get through the whole article thoroughly and get the latest review on PayDaySay.

Author Profile

- John Davis is a nationally recognized expert on credit reporting, credit scoring, and identity theft. He has written four books about his expertise in the field and has been featured extensively in numerous media outlets such as The Wall Street Journal, The Washington Post, CNN, CBS News, CNBC, Fox Business, and many more. With over 20 years of experience helping consumers understand their credit and identity protection rights, John is passionate about empowering people to take control of their finances. He works with financial institutions to develop consumer-friendly policies that promote financial literacy and responsible borrowing habits.

Latest entries

BlogJuly 8, 2024How to Fast-Track Approval for Section 8 Vouchers

BlogJuly 8, 2024How to Fast-Track Approval for Section 8 Vouchers BlogJuly 8, 2024Unlock Apple Business Credit with No Credit Check Needed

BlogJuly 8, 2024Unlock Apple Business Credit with No Credit Check Needed BlogJuly 8, 2024A $18 Million Per Year Investment Plan for Democrats to Control the Texas House

BlogJuly 8, 2024A $18 Million Per Year Investment Plan for Democrats to Control the Texas House Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide