Do you always keep falling out of your budget? Do you want to plan your expenses but do not know how to do that? Do you think that planning a budget takes a lot of time? Are you one of the 72% of Americans who are struggling with managing their finances?

Yes, you heard it right. So, as per research by the U.S. Bank, 72% of Americans are struggling with managing their budget. For 45% of Americans the reason for this is money, while for the other 27% of people, it is time. Though according to the study conducted by the Federal Reserve Report, 45% of Americans keep close track of their budget and expenses.

Planning, managing, and following a budget can be a tough task. But it is necessary to keep track of your money and save some for your emergency fund as well. If you’re also struggling with managing your budget then we got a perfect solution for you, the budget spreadsheet. It is easy to use and doesn’t take much time as well.

What is Budget Spreadsheet?

A budget spreadsheet is a simple sheet with rows and columns where you can record your income, expenses, and savings. It helps keep everything in one place so that you can manage everything easily. The simplicity or complexity of a budget sheet depends on your needs.

In this world where buying anything is just one click away, the budget spreadsheet can be your lifesaver. Here you can record, calculate and organize the numerals so that you can take charge of your money and spend it wisely. It also saves you from taking payday loans.

Which Budget Spreadsheet is Perfect for You?

There are many budget spreadsheet templates available in the market. But the real challenge is finding the right one for you. It’s not always about the design or template, it’s about your needs, and what you want to track or record. Before finalizing any particular spreadsheet for you, consider the following points.

- Is it straightforward?

- Is it easy to use?

- Can you twist it as per your needs?

- Is it covering all your major points?

You can have as many points as you want. The budget spreadsheet that fulfills all your needs and is easy to use is the right one for you. You can check the budget sheets that are available online.

Best Ways for Your Finance Tracking

![]()

When it comes to budgeting your finance, there are five best ways to do that-

- Budget Spreadsheet (Microsoft Excel or Google Sheets)

- Free budgeting app

- Downloading a budget spreadsheet template from the internet

- Making your budget sheet with pen and paper

- A paid tool for budget

You’re the one that is going to track the budget, so make sure you choose the one that fits all your needs. Also, choose the one that can be easily customized whenever needed. Microsoft Excel and Google Sheets, both offer tools to manage your budget. If you want to manage things from your mobile, you can go for budgeting apps as well.

Best Budget Templates

Now that you are all aware of what a budget spreadsheet is and how you can use it, we would like to tell you about the best templates that you can choose from. Go through our list and choose the best template for you.

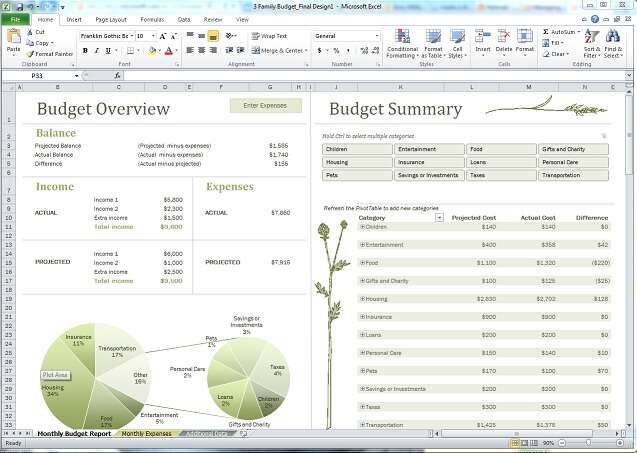

Spreadsheet from Microsoft Office

If you find it easy to work with your computer then the monthly spreadsheet from Microsoft could be a perfect choice for you. You can manage everything from your rent, wedding, and medical expenses. They have simple tools to do all the mathematical calculations for you. Once you figure out where you are spending your extra cash, you can save that money.

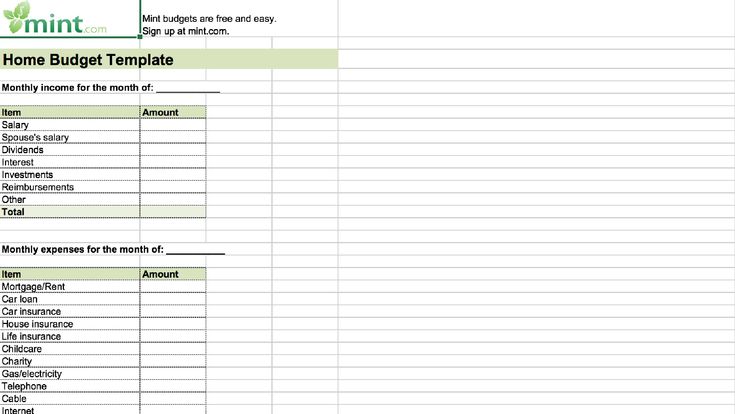

Spreadsheet from Mint

This budget spreadsheet comes in quite handy. Be that your college expenses, medical bills, or rent, you can manage it all in the monthly Mint Spreadsheet. If you’re adulting then this is the perfect time to learn budgeting and this spreadsheet can help you with that. Manage everything as per this list and see where you could save and from next month, start saving that money.

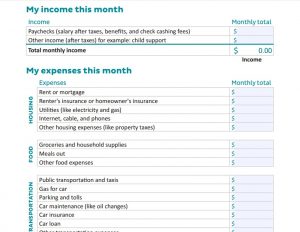

Spreadsheet from Consumer.gov

If you are starting with planning your budget and want a simple budget spreadsheet, then this template can be perfect for you. All you need to do is, fill in your monthly income and then your daily expenses for the first month. Now that you know about your monthly expenses, try sticking to them for the upcoming months. See where you could save money and from next month, add that amount to your emergency funds because it will help you with your emergency money requirement.

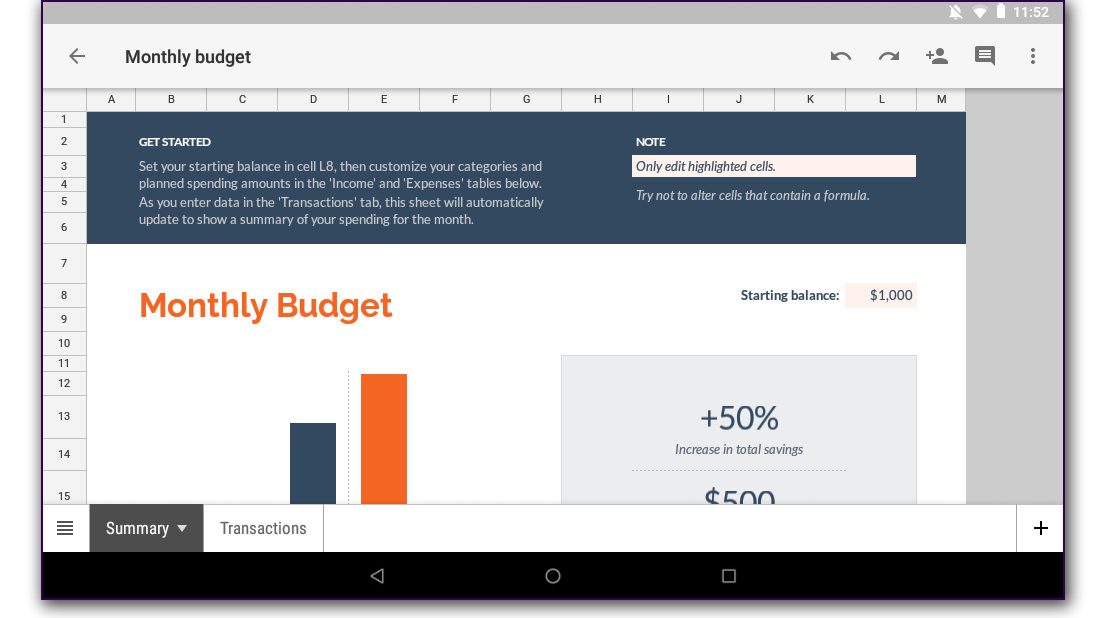

Spreadsheet from The SavvyCouple

Are tired of living from paycheck to paycheck and want to manage your budget and save some money? If yes, then the monthly budget spreadsheet from The SavvyCouple could be a perfect choice for you. This template is very simple and easy to use. It can easily be customized as well. You can simply download this template from the internet and take control of your money.

Dave Ramsey Budget Worksheet

When nothing helps, Dave Ramsey Budget Worksheet comes to your rescue. Dave Ramsey Budget forms are easy to use. Their budget spreadsheet consists of 2 types of forms, the monthly cash flow plan Dave Ramsey form, and the irregular planning funds form. These forms work together to provide you a strong base on how much money you need to spend Versus much money you are spending right now. Once you figure out where your money is leaking, you can easily fix it.

Frequently Asked Questions (FAQs)

Q1 How to make a budget spreadsheet in excel?

Making a budget spreadsheet on Microsoft Excel is very easy. On one axis you can mention your total income and on the other axis, you can mention the things you spend money on. Then as you spend money, keep mentioning the amount of money you’re spending against the thing you spend money on. Also, keep deducting that amount from your total amount so that you know how much money you’re left with.

Q2 How to manage your money worksheets?

You can make your worksheet as per your needs or you can download any budget spreadsheet template that works for you. After this, you need to record all your income and expenses on the sheet. At the end of the month, you’ll get to know how much money you spent and how much money you could save.

Q3 How to use the excel budget template?

To use the excel budget template you can simply download the available template and then record your monthly income on the top. Then keep mentioning all your expenses as soon as you spend money on them. Also, keep deducting that amount from your total amount.

Final Say

It is very important to plan your budget so that you can have some savings for your emergency funds or plan the luxury vacation that you always wanted to go on. After all, it’s better to have your own money in your hand rather than take a loan now and then.

If you can’t figure out on your own how to manage your budget, then you can take the help of the available templates or budgeting tools to plan your budget. This way, you’ll easily figure out where your money is leaking, and once you know the disease you can easily cure it.

Once you’re pro at this, you can plan your expenses and savings. You can decide how much money you want to spend on a particular thing. This way you can save more money than usual.

Author Profile

- David Garcia is a nationally-recognized consumer and money-saving expert who helps people make smart decisions with their money. He has been featured on NBC’s Today Show, Good Morning America, ABC News, and CNBC as well as in The New York Times & other media outlets. With more than 13 years of experience in the personal finance space, David is an experienced writer and researcher. He has written for major publications where he provides readers with actionable advice to save money on groceries, insurance, and more. With his work for various publications, David is an active contributor to the Credit Card Insider blog where he shares insights into credit cards such as rewards programs and interest rates.

Latest entries

Loan App ReviewsApril 30, 20235K Funds Review: Analysis of the Online Loan Platform

Loan App ReviewsApril 30, 20235K Funds Review: Analysis of the Online Loan Platform BlogApril 30, 2023Top 5 Cheapest States to Live In 2024: A Comprehensive Guide

BlogApril 30, 2023Top 5 Cheapest States to Live In 2024: A Comprehensive Guide BlogMarch 21, 2023How Much is 6 Figures? How to Make a 6 Figure Salary?

BlogMarch 21, 2023How Much is 6 Figures? How to Make a 6 Figure Salary? BlogMarch 20, 2023What is Chime Spot Me? Features, How to Use & More

BlogMarch 20, 2023What is Chime Spot Me? Features, How to Use & More